Best Virtual & Outsourced Accounting Services 2023

As they grow, these firms end up hiring more people locally, in roles that require a higher level of skill. Whether you lack in-house F&A experience to address a complex project or the capacity to take on an interim need, we can plug in to assist you. We provide hands-on resources to help stand up your department and meet urgent demands and deadlines. land depreciation Our technology can automate and integrate your transaction workflow, giving you real-time visibility into your business and freeing you to concentrate on your core competencies. Companies looking to sell must have impeccable finances to get their full valuation. TGG’s GAAP compliant reporting gives buyers confidence in the value of your business.

Determine which accounting functions to outsource

Set up restricted user accounts, and only provide access to the systems and data that are needed for the provider to perform their tasks. Many companies outsource this task to experienced auditors, who can independently assess your company’s financial processes and even advise on ways to improve. Learn about accounting firm management styles and apply frameworks and methodologies like Scrum, Kanban, and Agile to your day-to-day accounting operations. Firm Forward is a guide for accounting firm leaders looking to add a global team to their business or have already done so. Bookkeeper.com is an all-around solid pick for small to midsize businesses that might want additional payroll and tax help down the road. But Merritt Bookkeeping is a cheaper option, inDinero has even more add-ons, Bench’s bookkeepers work seamlessly with your own CPA, and Bookkeeper360 integrates with some of our favorite HR and payroll providers.

Cost effective

An outsourced CFO should be a trusted strategic partner with whom you work intimately – not just another vendor. To learn more about how we can help, speak to one of our friendly experts today — or check out our in-depth payroll processing guide. However, this can be mitigated significantly by choosing the right accounting partner and building a positive relationship.

Outsourcing is a Practice for Large Companies

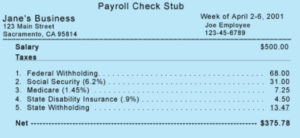

When you outsource, you’re tapping into decades of experience and expertise across multiple facets of accounting. This ensures you’re getting the best support and advice on a range of financial matters, from tax planning to financial forecasting and budgeting. Prioritize critical tasks essential to your firm’s long-term success while your outsourced accounting team manages routine tasks. Permanently increase your firm’s capacity with a dedicated outsourced accounting team in weeks, not months. Effortless payroll outsourcing solutions with compliance, data management, RTI, IRS guidelines adherence, empowering focus on business growth with streamlined operations. At QX Accounting Services, we assess your accounting firm’s requirements and offer flexible engagement models with PTEs/FTEs with a managed approach for that extra layer of review.

Accounting Service: IN-HOUSE VS OUTSOURCE

Knowing what these are beforehand will help you embark on the process as seamlessly as possible. While our article on what clients will think of your outsourcing strategy goes further https://www.wave-accounting.net/ into detail, firms that have been outsourcing for a while have seen the value first-hand. BDO is the brand name for the BDO network and for each of the BDO Member Firms.

A lot of companies might put their best talent on a pilot project to get your business, but that doesn’t necessarily mean that they will continue to deliver the standards you had initially envisioned. Outsourcing can help you easily keep your business running around the clock at a fraction of the cost. We’ll help migrate to modern technologies, set everything up, and even train your team on how to use it. With Decimal coordinating all the bill pay activities, you’ll have up-to-date reporting on what’s due and when. In tax season or other busy periods, we enable US CPAs to quickly scale up with us to meet staffing shortages. US CPAs can eliminate operational bottlenecks & streamline workload through our quick turnaround time and 2 stage review process.

- For companies poised for growth, we provide technical accounting support around business and capital-raising transactions so your team can stay focused on the end goal.

- It’s a strategic choice that brings expertise, efficiency, technological advancement, and focused business growth.

- When you hire an outsourced team, you don’t have to invest in training and setup costs.

- We understand your finance and accounting (F&A) teams are stretched thin yet must still navigate critical improvements strategically to meet business goals.

- As well as helping you comply with all relevant laws, this ensures that you are fully prepared if your company gets audited.

- We develop a customized plan for getting your accounting on the right track so you can achieve your goals.

They also leverage advanced software to keep their work efficient, transparent, and easily accessible for the client. Plus, they have built-in support for accounting software like QuickBooks Online, Bill.com, NetSuite, Expensify, and others, so they can seamlessly integrate with your team. However, while your outsourcing partner can prepare these statements to save you time and resources, you will likely review them for accuracy before passing them on to your clients.

To learn more about LBMC’s outsourced accounting services, contact an advisor today. At LBMC, we’re proud to provide outsourced bookkeeping, controller, and CFO services to businesses in Tennessee, Kentucky, Indiana and beyond. Our team has experience across a wide variety of industries, from well-established construction and real estate businesses to new companies in emerging markets including the brewery and hemp industries. That means you won’t get to spend as much face-to-face time with your accountant as you would if they were your employee. If you’re bringing in an outsourced controller to help manage your existing team, it’s necessary to carefully consider what this relationship will look like.

It stands alongside IT as one of the most commonly outsourced business processes, meaning discussions around outsourced accountants are bound to come with many trends, opinions, and misconceptions in tow. So, as a global talent solutions provider in the accounting industry, we thought we’d help paint a fuller picture and, in turn, do our part in separating the facts from some popular fiction. Outsourcing accounting functions can be an effective way for small and medium-sized businesses to reduce costs and increase efficiency. However, choosing the right outsourced accounting provider can be a challenging process. Using a consultative approach, we aim to bolster your F&A capabilities and strengthen reporting and compliance to help you navigate complex regulatory shifts and high-stakes transactions with confidence.

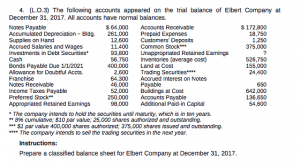

The four main financial reports are the income statement, balance sheet, cash flow statement, and statement of retained earnings. Effective management is imperative to ensure security and compliance and allow for audits or investigations. To accomplish this, accountants create records of transactions and properly save and retain files with the help of software tools. Helpful software tools utilize taxonomies and retention schedules to streamline organizing records. The entailments of accounts receivable for the accountant are to prepare customer payments and transactions, create invoices, submit invoices to customers, and maintain customer files. We’ve worked with many clients and this experience has helped us to identify several common outsourcing missteps.

Our focus on outsourced accounting services for a few key industries has given us extensive knowledge of the accounting software our clients use, setting our advisory services at the top of the charts. Our commitment to serving our clients means our accounting team has seen it all, and we are the right accounting firm to take your growing small business to the next level. Instead of hiring a full-time employee to handle accounting and bookkeeping tasks, a company can outsource accounting work to firms that provide various accounting services. Once a business decides to outsource, they then can choose what accounting functions they would like to get help with. Some companies prefer only to have help with daily reconciliation, while others want to have the bulk of the accounting work taken care of.

Smaller businesses might get by with a basic Quickbooks set-up, but once you start growing, building a more sophisticated financial infrastructure is vital. Staffing an internal finance and accounting team is expensive and can place significant demands on your time. Our outsourced accounting firm does more than just track your numbers — we offer industry-specific insights to help you take action to grow your business. Outsourced, virtual bookkeeping can cost as little as $150 per month and as much as $900 (or more) per month. Some companies charge by the number of accounts you need them to manage, while other companies charge based on your company’s monthly expenses.

The virtual bookkeeping providers above might be our favorite—but if they don’t quite fit your needs, we understand completely. Bookkeeper360 offers a pay-as-you-go plan that costs $125 per hour of on-demand bookkeeping support. It’s an ideal plan for businesses that need minimal monthly support, though if you want more than two hours of help a month, you’ll save more money simply going with a service like inDinero or Bench.co. Programmers.io is an India based software development company that offers affordable IT services on multiple platforms like Java, IBM, Dot Net, etc.

Outsourcing your bookkeeping to an accounting firm ensures that your business’s financial data is organized according to best practices. https://www.accountingcoaching.online/the-relevant-range-and-nonlinear-costs/s tend to use cloud-based bookkeeping technologies that provide business owners with a real-time overview of their business’s financial position. Today, the average salary for a bookkeeper in the U.S. is $45,160, the average controller earns $104,338, and the median CFO salary is $393,377. By comparison, outsourced accounting services typically cost a fraction of these rates and deliver better results.

Today, AI is not merely a trendy term in the accounting industry; it’s a transformative tool reshaping the execution of accounting tasks. Experience accounting excellence with our elite team of US accounting and taxation experts. One of the very few accounting outsourcing organizations that are SOC2 Type 2 Compliant, QX Accounting Services meets all the data protection and privacy regulations underlined by AICPA. We are also certified with ISO27001 for security and ISO9001 for quality management. With a steady stream of talented accounting professionals from QX Accounting Services’ Academy, our clients never face a capacity issue.