What Is Book Value Per Share BVPS?

Investors typically view a P/B ratio below 1.0 as an indication of undervaluation. Although the meaning of a “good PB value” differs by industry, some experts consider any value below 3.0 to be favourable. Clear differences between the book value and market value of equity can occur, which happens more often than not for the vast majority of companies. With those three assumptions, we can calculate the book value of equity as $1.6bn. Remember, even if a company has a high book value per share, there’s no guarantee that it will be a successful investment.

How does BVPS differ from market value per share?

For example, in the above example, Company X could repurchase 500,000 shares to reduce its outstanding shares from 3,000,000 to 2,500,000. Let’s say that Company A has $12 million in stockholders’ equity, $2 million of preferred stock, and an average of 2,500,000 shares outstanding. You can use the book value per share formula to help calculate the book value per share of the company. To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding. For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1.

Repurchase Common Stocks

He died the year after, aged 77, while still under investigation, with the Makin Report finding that he was “never brought to justice”. Book value example – The balance sheet of Company Arbitrary as of 31st March 2020 is presented in the table below. For instance, if a piece of machinery costs Rs. 2 lakh and its accumulated depreciation amount to Rs. 50,000, then the book value of that machinery would come about to be Rs. 1.5 lakh. InvestingPro offers detailed insights into companies’ Book Value Per Share including sector benchmarks and competitor analysis.

The Formula for Book Value Per Common Share Is:

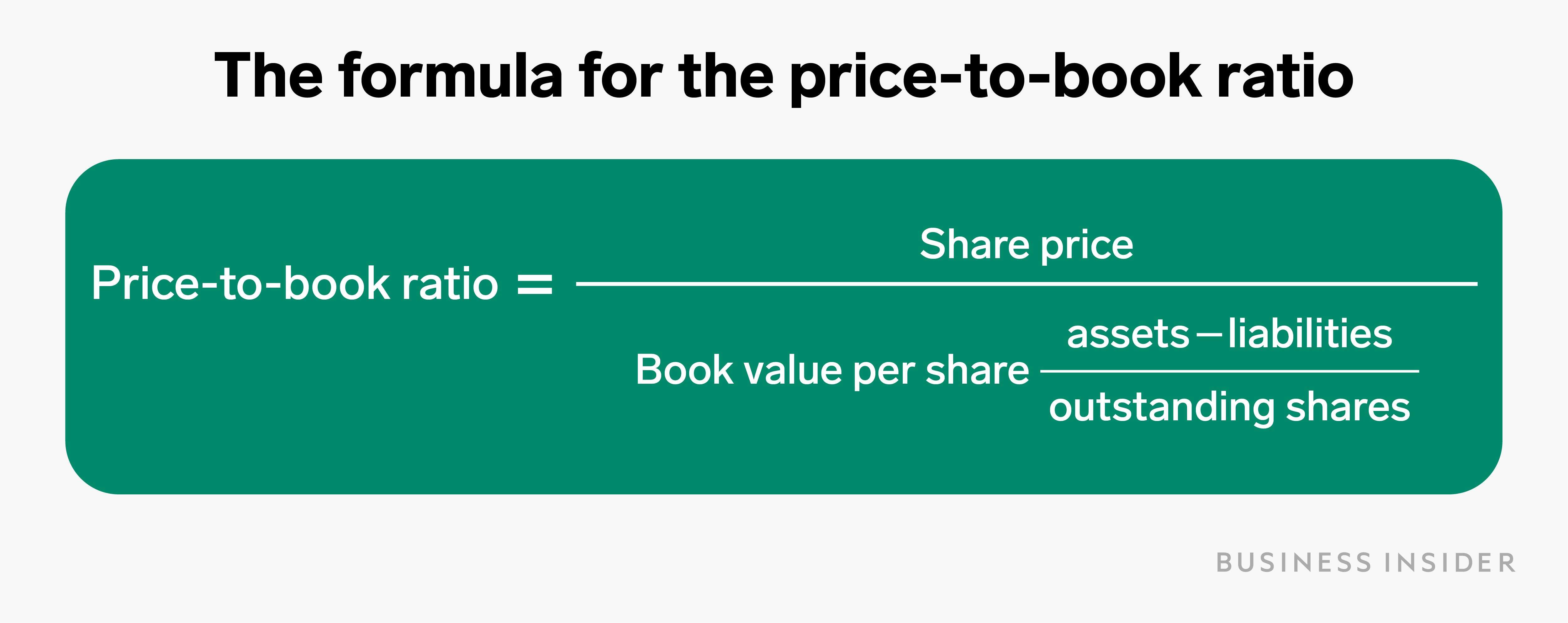

In theory, book value should include everything down to the pencils and staples used by employees, but for simplicity’s sake, companies generally only include large assets that are easily quantified. The company’s current stock price per share is divided by its book value per share (BVPS) to come up at this ratio. An even better approach is to assess a company’s tangible book value per share (TBVPS). Tangible book value is the same thing as book value except it excludes the value of intangible assets.

In this case, the company’s price/BVPS multiple seems to have been sliding for several years. In this case, the stock seems to trade at a multiple that is roughly in line with its peers. It can and should be used as a supplement to other valuation approaches such as the PE approach or discounted cash flow approaches. Like other multiple-based approaches, the trend in price/BVPS can be assessed over time or compared to multiples of similar companies to assess relative value.

For example, Walmart’s January 31, 2012 balance sheet indicates that shareholders’ equity has a value of $71.3 billion. The number is clearly stated as a subtotal in the equity section of the balance sheet. To calculate BVPS, you need to find the number of shares outstanding, which is also usually stated parenthetically next to the common stock label (on Yahoo! Finance, it’s located in Key Statistics). What we’re looking for is the number of shares outstanding, not simply issued. The two numbers can be different, usually because the issuer has been buying back its own stock.

You also need to make sure that you have a clear understanding of the risks involved with any potential investment. BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities. If it’s obvious that a company is trading for less than its book value, you have to ask yourself why other investors haven’t noticed and pushed the price back to book value or even higher.

- The difference between book value per share and market share price is as follows.

- But an important point to understand is that these investors view this simply as a sign that the company is potentially undervalued, not that the fundamentals of the company are necessarily strong.

- If a company has a book value per share that’s higher than its market value per share, it’s an undervalued stock.

- At the time Walmart’s 10-K for 2012 came out, the stock was trading in the $61 range, so the P/BVPS multiple at that time was around 2.9 times.

- These intangibles would not always be factored in to a book value calculation.

Value investors look for relatively low book values (using metrics like P/B ratio or BVPS) but otherwise strong fundamentals in their quest to find undervalued companies. It depends on a number of factors, such as the company’s financial statements, competitive landscape, and management team. Even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. This is why it’s so important to do a lot of research before making any investment decisions. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors.

Intangible assets have value, just not in the same way that tangible assets do; you cannot easily liquidate them. By calculating tangible book value we might get a step closer to the baseline value of the company. It’s also a top 4 tiers of conflict of interest faced by board directors useful measure to compare a company with a lot of goodwill on the balance sheet to one without goodwill. In the food chain of corporate security investors, equity investors do not have the first crack at operating profits.